vermont state tax rate 2021

Vermont Meals Tax on Vending Machines. TAX TABLES Place at.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Tax Rates for Cigarettes Tobacco.

. State government websites often end in gov or mil. Vermont also has a 600 percent to 85. 2021 Vermont Tax Tables.

Find your income exemptions. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. The major types of local taxes collected in Vermont include income property and sales taxes.

Vermont Income Tax Rate 2020 - 2021. Minimum Wage Increases to 1255. Learn about Vermont tax rates rankings and more.

State government websites often end in gov or mil. How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table. Any income over 204000 and 248350 for.

Explore data on Vermonts income tax sales tax gas tax property tax and business taxes. 2021 Vermont Per Capita Personal Income in Current Dollars was 59704 ranking the state 23 rd highest. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Vermont Tax Brackets for Tax Year 2020. Vermont state tax 4514. VT Taxable Income is 82000 Form IN-111 Line 7.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. Filing Status is Married Filing Jointly. What Is the Tax Rate in Vermont.

As you can see your Vermont income is taxed at different rates within the given tax brackets. Than filing filing house- jointly. Find your pretax deductions including 401K flexible account.

If youre married filing taxes jointly theres a tax rate of 335 from 0 to. Calculations are estimates based on tax rates as of Dec. IN-111 Vermont Income Tax Return.

Provided the state does not have any outstanding Title XII. And your filing status is. These taxes are collected to provide essential state functions resources and programs to.

Vermont Rooms Tax for Businesses. State government websites often end in gov or mil. In Vermont theres a tax rate of 335 on the first 0 to 40350 of income for single or married filing taxes separately.

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on. Exact tax amount may vary for different items. Before sharing sensitive information make sure youre on a state government site.

Before sharing sensitive information make sure youre on a state government site. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Vermont State Tax Calculator. If Taxable Income is.

On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes. They vary based on your filing status and taxable income. Charts and data available at Wages Income.

At Least But Less Single Married Married Head of. Tax Rates and Charts Tuesday. Before sharing sensitive information make sure youre on a state government site.

The Vermont Department of Labor announced that its fiscal year 2022 July 1 2021 June 30 2022 state unemployment insurance SUI tax rates are determined on Rate Schedule III with. 2022 Vermont state sales tax. The 2022 state personal income tax brackets.

Vermont has four state income tax brackets for the 2021 tax year. Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules.

Novel Coronavirus Covid 19 Vermont State Response Resources Office Of Governor Phil Scott

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

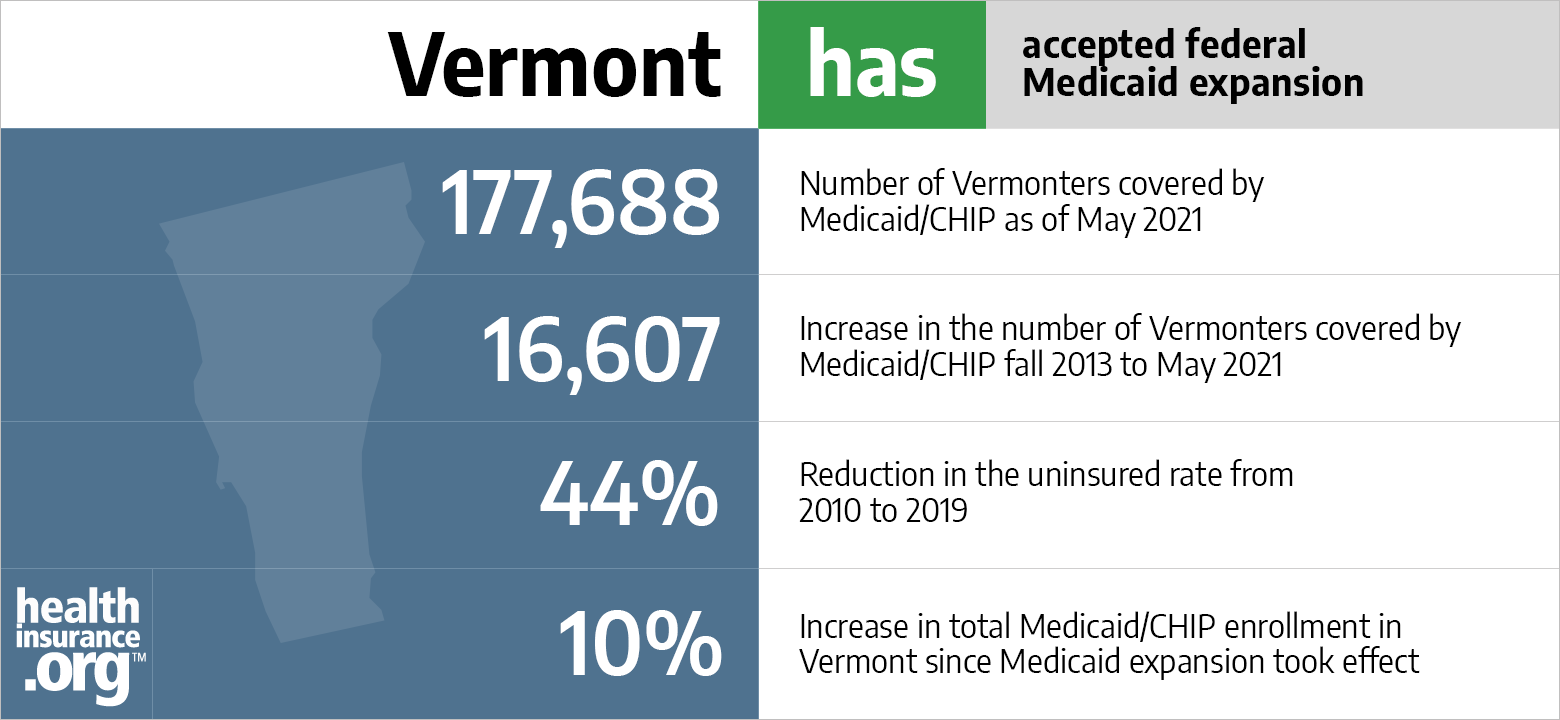

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

State Income Tax Rates Highest Lowest 2021 Changes

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Historical Vermont Tax Policy Information Ballotpedia

States With The Highest Lowest Tax Rates

Novel Coronavirus Covid 19 Vermont State Response Resources Office Of Governor Phil Scott

Pai Vermont School Funding Questions Answered Vermont Business Magazine

Service Tax Study Prompts Alarm The White River Valley Herald

States With The Highest Lowest Tax Rates

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Analysis Potential Commercial Cannabis Demand Sales And Tax Revenue In Vermont Vicente Sederberg Llp

Where S My Refund Vermont H R Block

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

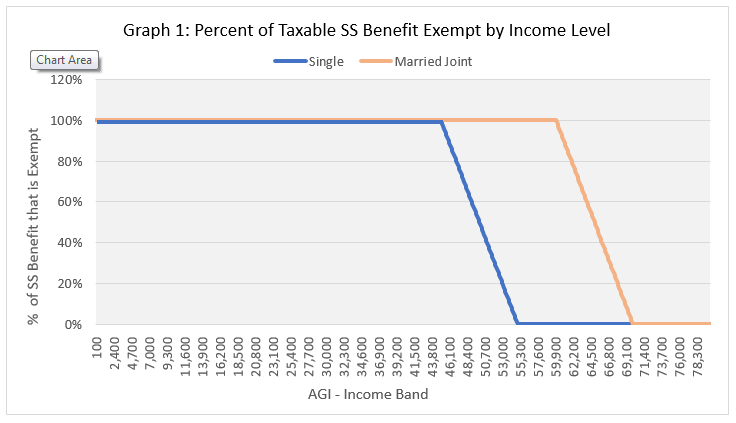

Social Security Exemption Department Of Taxes

Tax Revenues Soar With One Time Money Vermont Business Magazine

Vermont State Tax Software Preparation And E File On Freetaxusa